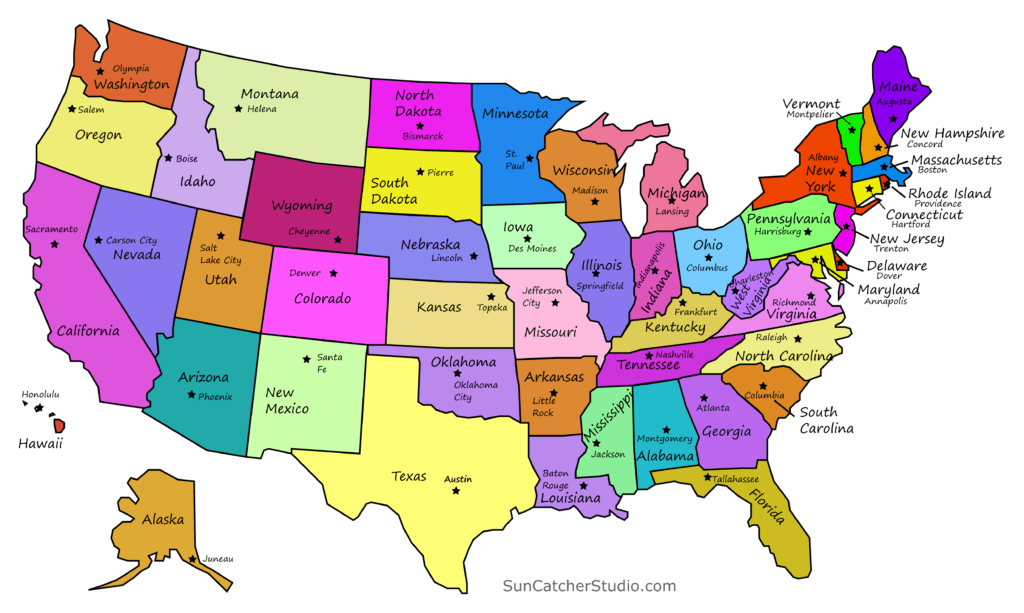

These are the states with the highest and lowest income tax burdens…

Highest income tax burdens:

- New York – 12.47%

- Hawaii – 12.31%

- Maine – 11.14%

- Vermont – 10.28%

- Connecticut – 9.83%

- New Jersey – 9.76%

- Maryland – 9.44%

- Minnesota – 9.41%

- Illinois – 9.38%

- Iowa – 9.15%

Lowest income tax burdens:

- Alaska – 5.06%

- Delaware – 6.12%

- New Hampshire – 6.14%

- Tennessee – 6.22%

- Florida – 6.33%

- Wyoming – 6.42%

- South Dakota – 6.69%

- Montana – 6.93%

- Missouri – 7.11%

- Oklahoma – 7.12%

There are seven states with no state income tax… these are:

– Nevada, Washington, South Dakota, Florida, Wyoming, Alaska and Texas.

Here are the states with the highest Sales Tax burden:

– Hawaii (6.71%), Washington, (5.66%) and New Mexico (5.62%)

And here are the states with the lowest Sales Tax burden:

– New Hampshire (1.07%), Delaware (1.09%) and Oregon (1.11%).

Should you inquire about any state tax related events, please contact our office at 310.666.0244

References Page:

Archie, Ayana. “These are the states with the highest and lowest tax burdens, a report says.” npt. URL: www.npr.org/2023/03/30/1166970506/tax-burden-by-state-income-property-sales.

https://www.cdtfa.ca.gov/taxes-and-fees/sales-use-tax-rates.htm